When analyzing financial ratios of several different but similar companies, a company can better understand whether it is an industry-leader or whether it is falling behind. How it is performing compared to its competitors.When analyzing financial ratios of a single company over time, that company can better understand the trajectory of its accounts receivable turnover. Slower turnover of receivables may eventually lead to clients becoming insolvent and unable to pay. If a company's accounts receivable turnover ratio is low, this may be an indicator that a company is not reviewing the creditworthiness of its clients enough. How sufficiently a company is evaluating the credit of clients.A company can project what cash it will have on hand in the future when better understanding how quickly it will convert receivable balances to cash. When it might be able to make large capital investments.Specifically, it helps calculate trends when they might otherwise be difficult to detect.

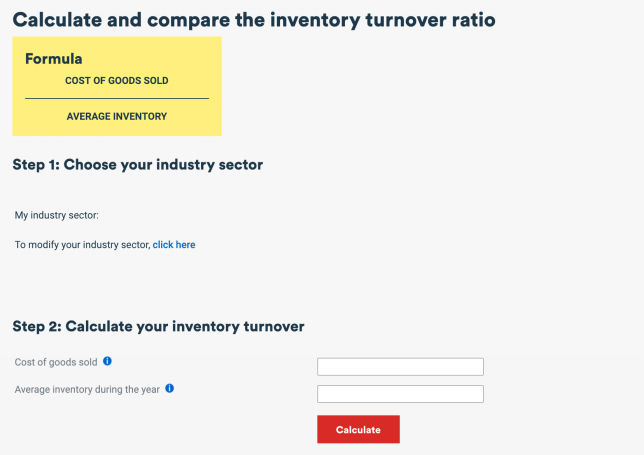

Your next 3 month's sales might look like this: August 2020: 54,200. As you continue, removing the earliest month's sales and adding in the next and completing the formula gives you each 12-month period's average. Some lenders may use accounts receivable as collateral with strong historical accounts receivable activity, a company may have greater opportunities to borrow funds. A rolling average, sometimes referred to as a moving average, is a metric that calculates trends over short periods of time using a set of data. As you continue, the rolling period keeps moving. What collateral opportunities a company may have.As a company processes receivable balances faster, it gets its hand on capital faster. From there, simply divide the total number of employee separations by the average number of employees during that period of time. In accounting practices, it is usually calculated for the year but could also be done on a monthly or quarterly basis. The two headcount totals are used to determine the average number of employees. Also referred to as stock turn, inventory turn, or stock turnover, inventory turnover is a measurement of the number of times inventory is sold in one year. How well a company is collecting credit sales. Turnover rate ( of employee separations) / (average of employees) x 100.

0 kommentar(er)

0 kommentar(er)